Many companies today are looking for ways to combat the increasing volatility of their self-funded health benefits.

Through its proprietary Precision Risk approach, Granular Insurance is able to segment risk, reduce variability and deliver a more accurate assessment of a client’s exposure.

Traditional employer stop-loss treats a covered population as a unit and builds protection around a single attachment point. With its Precision Risk approach, Granular segments a population into as many as 22 unique cohorts. By doing this, Granular is able to more accurately assess risk, monitor and impact the group’s performance and better manage costs.

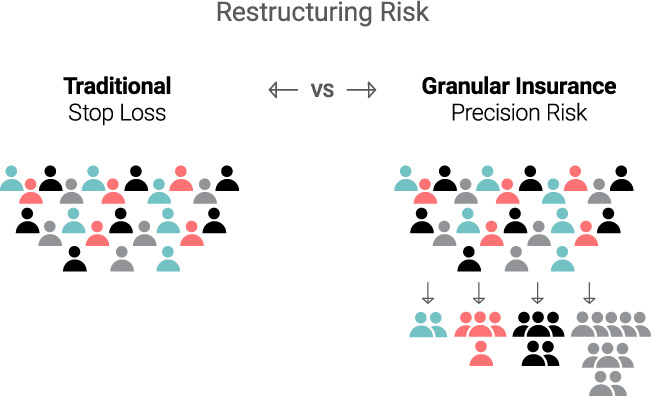

Restructuring Risk

- Traditional stop-loss models look at an employer’s membership through the lens of a single risk grouping.

- Granular’s Precision Risk model offers employers the opportunity to segment each member into one of 22 optimal cohorts by assessing the risk profile of every individual.

- Granular’s Precision Risk model reduces volatility and provides more consistent value from year to year.

- Segmenting members into risk categories improves visibility into the entire population and provides better analytics for plan design and care management decisions.

The road ahead is uncharted. When it comes to insurance, nobody likes surprises. Granular Insurance places self-funded employers on a path of greater certainty with its multi-year rate and benefit guarantee: a meaningful cap on annual premium increases with moderate and predictable changes to an employers’ spec.

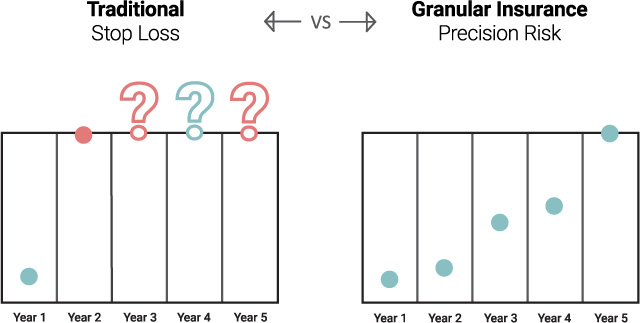

Financial Predictability

- Today, many traditional stop loss carriers offer a one year, 50%, No New Laser, rate cap.

- With confidence in the Precision Risk model, and a commitment to longer term partnerships, Granular Insurance offers clients three to five year, Earn-to-Cap rate and coverage guarantees.

- For select clients, Granular will offer a three to five year rate guarantee, with a cap on annual premium increase ranging from 18% to 35%. The cap number determination will be based on Granular’s transparent, actionable, and dynamic Scorecard.

- Granular tightens this guarantee by offering a parallel cap on the cost-based composite spec deductible of no more than 2% to 7% a year.

- Granular delivers meaningful, longer-term, financial predictability.

There will always be variability. Granular’s Precision Risk underwriting delivers better estimators and tighter clusters of expected claims costs across the employers’ population, allowing Granular to offer attractive rates and multi-year rate and benefit guarantees.

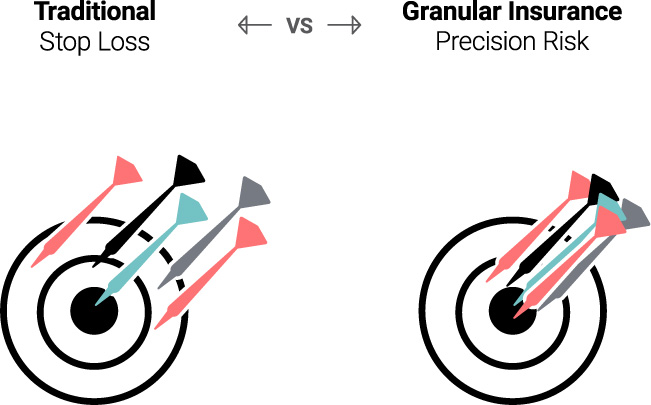

Underwriting Predictability

- Traditional stop-loss underwriting factors in high-dollar claims, demographics, geographic factors and business sector.

- While Granular Insurance does look at these factors, it also harnesses Precision Risk analysis on first dollar claims for every member of the population.

- This takes into consideration the surprisingly high volume and volatility around lower and mid-range claims.

- There is a more consistent and predictable risk transfer between the employer and Granular Insurance.

- In 75% of 10,000 test cases, employers received more value from Granular’s Precision Risk approach.

With its Precision Risk approach, Granular Insurance offers protection from higher frequency and higher volatility claims through a mix of specific employer stop-loss deductibles, lowering employer risk both at the member level and overall level. This helps shift risk from employer to Granular.

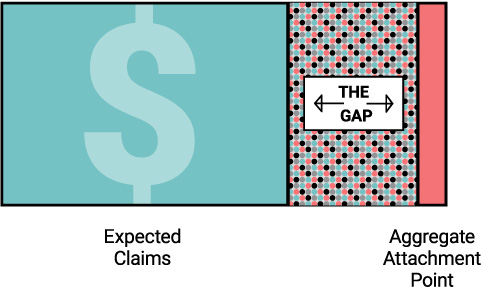

Mind the Gap

- For employers that have spec and agg coverage, the Gap is the exposure above expected claims and below that aggregate attachment point.

- For employers that only purchase spec coverage, there is still exposure, and potential ‘claims creep’ above expected claims.

- Consultants and Carriers all focus on protecting against high-dollar claims.

- Data show that low and mid-level claims contribute significantly to overall claims volume and bring costly and unwanted volatility.

- With Precision Risk segmentation and deductible cohorts with the potential to be as low as $20K, Granular Insurance brings great focus to these low and mid-level claims providing opportunities for conversation, collaboration, savings, and better health outcomes.

- When a large actuarial firm simulated thousands of test cases, they found that over 75% of employer groups received greater value from Granular’s low deductible cohorts and Precision Risk segmentation.

- This approach better manages volatility and delivers optimal risk transfer and meaningful financial predictability.

- It allows employers to better control ‘claims creep’ and to mind the Gap.

Granular offers a dedicated and experienced team that leverages claims insights to provide an active second set of eyes for our clients, identifying opportunities for optimal outcomes.

Case Studies

Health & Risk Solutions

- Active Collaboration: Implementing client-centric Cost Containment Strategies.

- Early Intervention: Utilizing Continuous Signal Management to improve Total Cost of Care.

- Risk Mitigation: Leveraging long-term partnerships with brokers, consultants, and employers.

- Precision Partnerships: Risk-scored collaborations for enhanced Clinical and Financial Outcomes.

- Ecosystem Optimization: Vetting partners and vendor solutions to streamline operations.

- Payment Integrity: Conducting thorough third-party bill reviews.

- Educational Support: Offering guidance on sustainable ERISA-compliant summary plan benefit language.

- Network consulting: For transplant contracting and cell & gene therapies.

Granular rewards employers for both the level of data they are able to share and the ecosystem partners with whom they work. The score generated through this process translates directly to meaningful, multi-year rate and benefit guarantees. The Scorecard is transparent, actionable, and dynamic, which gives employers control over their financial destiny.

Scorecard

- The Scorecard offers a variety of levers, so there are multiple paths to higher scores.

- The Scorecard offers an employer a pathway to meaningful, longer term financial predictability.

- Granular evaluates partner solutions through an in-depth RFI and validation process.

- The ecosystem categories align with the abilities of critical partnerships to influence the cost and management of care.

- The program is transparent so an employer can see the impact their actions will have on the length and nature of the Granular multi-year rate cap.